|

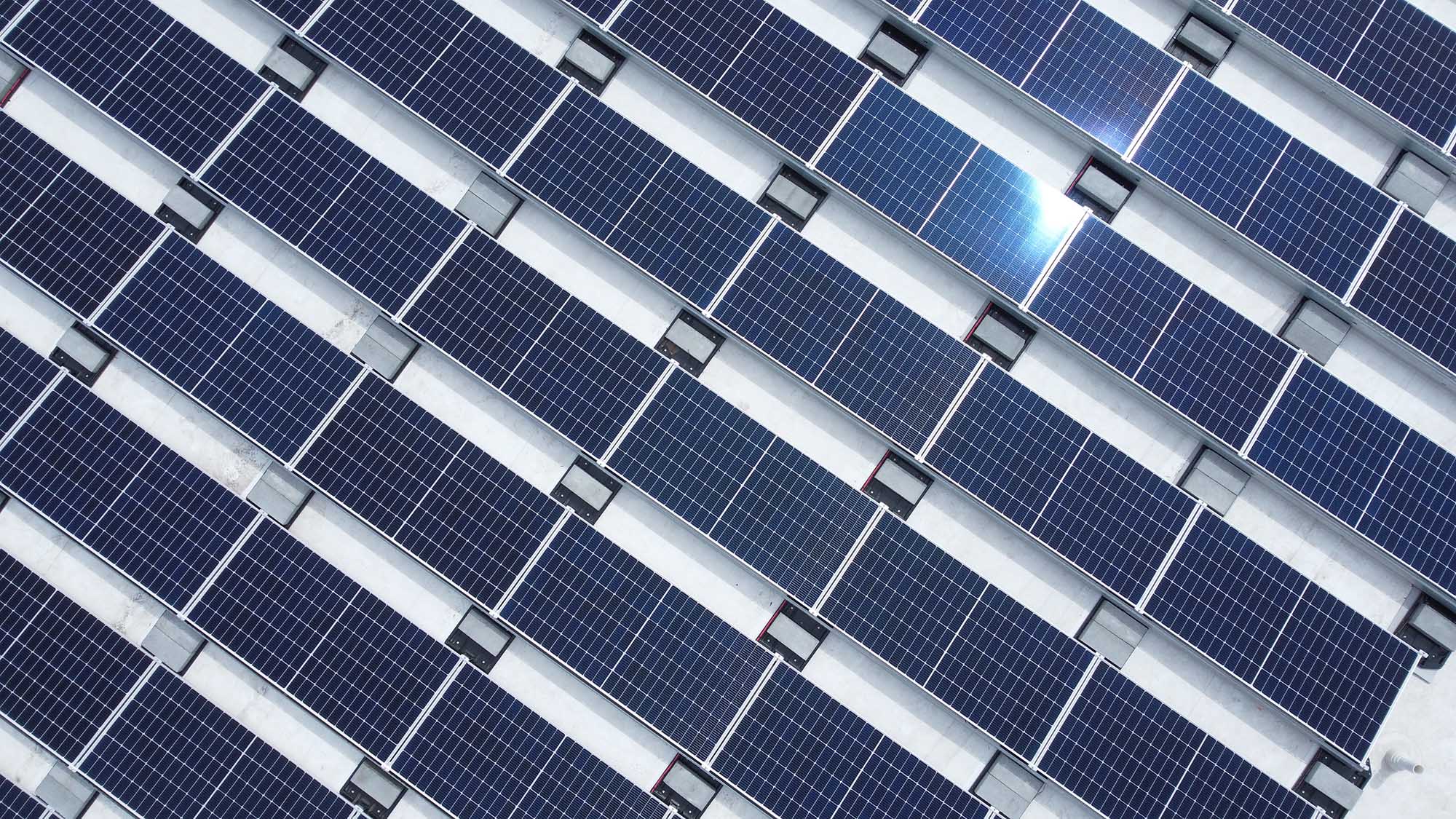

In late June, Senator Jon Ossoff of Georgia introduced the Solar Energy Manufacturing for America Act to the U.S. Senate. Citing President Bidens goal of decarbonizing the grid by 2035, the bill focuses on supporting American solar manufacturers in an effort to revitalize domestic solar production capabilities. Such a bill has been viewed favorably by environmentalists and the solar industry as a means of achieving those increasingly popular goals. |

Political support for renewable, carbon-neutral energy sources is widespread among voters, with more than 80% of adults voicing their support for increased reliance on solar power. In order to satisfy citizens and meet the climate challenge head-on, domestic production of renewable energy needs to increase, especially solar photovoltaics. The economic benefits of job production and innovation that may come from increased funding from the federal government should help the American solar industry continue to grow over the next decade.

Senator Ossoffs bill can help lead the way toward the deployment of new solar power. The bill focuses on supplying financial support and incentives in multiple key points in the solar energy manufacturing process. These areas include the production of modules, photovoltaic cells, and polysilicon designed for solar panels. Each of these steps has the potential to generate more research and innovation and job opportunities if it is given the proper support.

The credits differ between sectors of the manufacturing process. As of now, the proposed credits provide 11 cents for modules scaled for their capacity, 4 cents for cells scaled for their capacity, 12 dollars per square foot for wafers, and 3 dollars per kilogram for polysilicon. Given that all of these credits scale with size, the bill would encourage manufacturers to increase their production capacity and generate more American-made products for the market.

The proposed tax credits will be available until 2028, followed by a two year phasedown. These new credits will dovetail with the recently proposed 10 year extension of the federal investment tax credit. In conjunction, these policies will reduce both the costs of manufacturers and the costs of consumers. Promotion of both the manufacturing and the adoption of solar technologies will generate continued growth for the industry in America.

Historically, the production of solar components has been concentrated in China, forcing the U.S. to import the parts to install solar generators. Subsidizing domestic production of the same parts will likely increase the competitiveness of American solar products in the global and domestic markets and give consumers more options. Doing so may drive innovation in the solar field, increase domestic job opportunities, and promote wider adoption of renewable photovoltaic technologies in the U.S. and world.